When you’re running a business, the line between you and your business can get blurry very quickly. One minute you’re paying for supplies with your own card, the next you’re juggling transfers between your personal and business accounts.

While it may not seem like a big deal, this kind of financial crossover can quietly turn into a mess, with tax and legal surprises lurking in the background. In this month’s newsletter, learn about the dangers of mixing personal and business finances – and what you can do to keep your money in check.

Also discover how to build a strong brand identity on a budget.

As always, please reach out with any questions and forward this information to anyone who may find it of value.

The Hidden Tax Perils of Mixing Personal and Business Finances

For small business owners, the line between personal and business life often blurs together. You might cover a client lunch with your personal credit card, or deposit a business payment into your personal account before transferring it to your business account.

But this kind of financial co-mingling carries real consequences. From tax headaches to legal vulnerability, mixing personal and business finances can quietly put you at risk.

Here’s why drawing a firm line matters more than you might think.

The IRS wants clarity

The IRS expects clean, traceable separation between personal and business transactions. When that separation is unclear, it raises red flags. Poor recordkeeping makes it harder to prove expenses, validate deductions, or demonstrate legitimate losses.

If you’re audited and can’t substantiate that a charge was for business purposes, the deduction is many times denied. You’ll likely end up paying more in taxes and potentially face penalties, even if the mistake was unintentional.

Tax season becomes more expensive

Blending your personal and business finances makes preparing your tax return inefficient and expensive. If your books are full of unclear or misclassified transactions, someone has to take the time to untangle the data. This will cost you either more time or more money.

Another potential problem is trying to recall whether a transaction was for business or personal purposes months after the fact. You may not be able to recall the purpose of a particular transaction. This uncertainty can lead to missed deductions, errors in reporting, and even fines if mistakes are discovered.

You may be undermining your legal protection

One key reason to form a legal entity like an LLC or corporation is to protect your personal assets from business liabilities. This protection only holds if you maintain clear boundaries between your business and personal financial activities.

When you dip into your business account to pay for personal expenses, or vice versa, you begin to erode that legal shield. Courts refer to this as piercing the corporate veil. If this happens, creditors or litigants can come after your personal assets to settle business debts.

Tips to keep your finances separate

Establishing clear financial boundaries doesn’t have to be complicated. The key is consistency and discipline. Here are several tips to do it effectively:

- Open a dedicated business bank account. If you haven’t already done so, open a separate bank account into which you’ll deposit all business revenue and pay out all business expenses.

- Set up a formal system to pay yourself. Rather than casually transferring money or using business funds directly, treat yourself like an employee. Schedule regular owner draws or payroll disbursements.

- Keep detailed records. Maintain receipts and documentation for all business transactions. Many apps allow you to photograph and store receipts instantly, reducing paperwork and confusion later.

- Ask for help. Please call if you’d like help setting up a system to keep your business and personal expenses separate, or if you have any other questions about improving cash flow for your business.

Building a Brand on a Budget

Creative ways to build a strong brand identity when marketing dollars are scarce

Building a memorable brand doesn’t have to drain your business’s bank account. In fact, when you don’t have a big budget, you’re often forced to think more strategically and creatively, which can lead to stronger, more authentic branding. Here are several practical ways to build brand identity without burning through a lot of cash.

- Create an eye-catching visual identity. Use free design tools like Canva or Adobe Express to create logos and social media graphics. Consider picking two fonts and two colors to keep it simple. Then be consistent. Your logo and colors should match across all platforms.

- Tell your story again and again. One of the best free branding tools is storytelling. People remember stories, not sales pitches. Craft and repeatedly share your founder or brand story, including why you started your business, what problems you’re solving, and what makes your business different. Use this story across all your social media channels, on your website’s About page, and include with any sales presentations.

- Leverage media channels you control. While you might not have the cash for paid media, you do have access to platforms where you control the narrative. Think of your website as your digital headquarters. A simple, clean site can do its job of telling your business’s story, along with the products and services you offer. For an email list, build it early and consistently stay in touch with your customers. And for social media, pick one or two platforms where your audience spends the most time, then post there consistently.

- Collaborate for more exposure. You don’t need a huge audience yourself if you can tap into someone else’s audience. Look for collaborative branding opportunities such as partnering with a complementary business for giveaways, or guest posting or getting interviewed on blogs and podcasts.

- Get press coverage the DIY way. Getting your story told through traditional media is still a great way to build a strong brand identity. Consider using platforms like HARO (Help a Reporter Out) to respond to journalist queries, or writing your own press releases and submitting them to niche industry publications and blogs. Another approach is to reach directly out to journalists or bloggers with a strong, short pitch tied to your story, not just your products or services.

Branding isn’t just about visuals. It’s your reputation – what people say about you when you’re not in the room. When money’s tight, focus on delivering real value, building trust, and showing up consistently. That’s how lesser-known brands become strong brands.

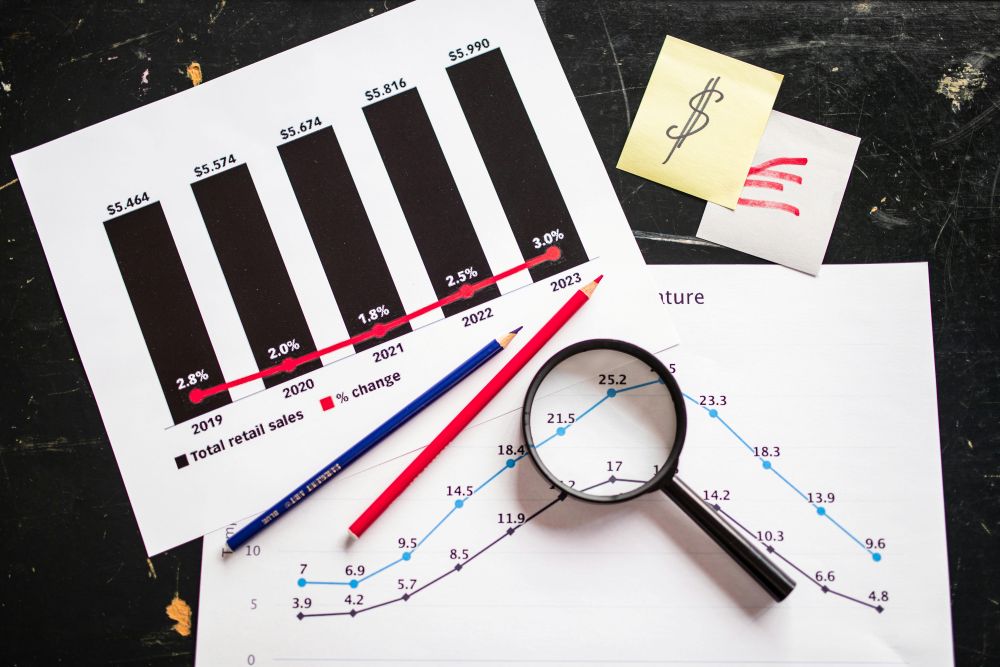

Leasing Commercial Property: What You Need to Know

Decisions about location and leasing commercial space can be significant factors in determining a business’s long-term profitability. That’s because the cost of leasing space is often one of the biggest numbers on the profit-and-loss statement. Consider the following as you look for a space that fits your bottom line:

- Give yourself time. At least six months before you plan to move in, begin the selection process. Scout out locations and narrow your choices. Waiting until you’re desperate for space may leave you with fewer options. Starting early may also provide opportunities to observe walk-by or drive-by traffic, the location’s visibility, and the habits of neighboring tenants. It may also provide more time to develop a better understanding of the level of lease payments your business can afford to pay.

- Compare properties. In addition to identifying a property that’s located near your client base, comparison shopping can give you a better understanding of the value of the property you’re considering, as well as provide negotiating leverage. Develop a matrix of the must-have elements of your location. Then place each location you are considering into the matrix. It will give you a nice comparative visual to help make the right decision.

- Negotiate terms! Use your location comparison matrix to begin negotiations with the landlord. Ideas include getting free rent while you build out your space, a longer term lease with no or low escalation of rent, and getting the landlord to cover more of the maintenance costs.

- Read the lease — then read it again. Once you’ve found your space and have the framework for a deal, you will receive your lease. Review the lease. Pay special attention to the length (term) of the lease, renewal options and scheduled rent increases. Scrutinize clauses describing your responsibility for utilities, maintenance and upkeep of common areas and systems. Make sure the lease agreement matches your understanding of the negotiated terms. The agreement must spell out your options for subleasing and delineate default provisions. Termination options, security deposits, allowances for leasehold improvements — all should be specified in the contract.

- Work with professionals. It makes sense to hire a real estate attorney and other professionals to help find the right space and review the lease terms before signing. An experienced broker may also provide assistance when negotiating lease terms. Careful evaluation and bargaining at the front end may save dollars and avert headaches later on.

If you have questions about how leasing a commercial space will affect your business tax plan, call today.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.This publication provides summary information regarding the subject matter at time of publishing. Please call with any questions on how this information may impact your situation. This material may not be published, rewritten or redistributed without permission, except as noted here. This publication includes, or may include, links to third party internet web sites controlled and maintained by others. When accessing these links the user leaves this newsletter. These links are included solely for the convenience of users and their presence does not constitute any endorsement of the Websites linked or referred to nor does Business Accounting Systems, P.C. have any control over, or responsibility for, the content of any such Websites. All rights reserved.